The Single Strategy To Use For Pvm Accounting

The Single Strategy To Use For Pvm Accounting

Blog Article

Unknown Facts About Pvm Accounting

Table of ContentsThe Greatest Guide To Pvm AccountingThe Ultimate Guide To Pvm AccountingFascination About Pvm AccountingThe 2-Minute Rule for Pvm AccountingThe Single Strategy To Use For Pvm AccountingAn Unbiased View of Pvm Accounting

Manage and handle the production and approval of all project-related billings to clients to foster excellent communication and stay clear of issues. financial reports. Guarantee that ideal reports and paperwork are sent to and are updated with the IRS. Make sure that the audit process abides by the regulation. Apply called for building accountancy criteria and procedures to the recording and reporting of construction activity.Understand and preserve standard cost codes in the bookkeeping system. Communicate with various funding agencies (i.e. Title Company, Escrow Company) concerning the pay application process and demands needed for payment. Manage lien waiver disbursement and collection - https://medium.com/@leonelcenteno/about. Screen and solve financial institution concerns consisting of cost abnormalities and examine distinctions. Aid with applying and keeping inner economic controls and treatments.

The above declarations are planned to define the general nature and level of work being carried out by people assigned to this category. They are not to be taken as an extensive checklist of duties, tasks, and skills required. Workers might be called for to perform obligations beyond their typical responsibilities every so often, as needed.

Not known Facts About Pvm Accounting

You will certainly assist sustain the Accel team to make certain delivery of effective on schedule, on spending plan, projects. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Construction Accounting professional performs a range of audit, insurance coverage conformity, and project administration. Functions both separately and within particular divisions to maintain monetary documents and ensure that all records are kept present.

Principal responsibilities consist of, yet are not restricted to, taking care of all accounting functions of the company in a timely and precise way and supplying records and timetables to the firm's certified public accountant Company in the prep work of all economic declarations. Ensures that all bookkeeping procedures and functions are taken care of precisely. In charge of all economic documents, payroll, financial and day-to-day procedure of the accounting function.

Prepares bi-weekly trial equilibrium records. Works with Project Supervisors to prepare and publish all regular monthly invoices. Procedures and problems all accounts payable and subcontractor repayments. Generates month-to-month wrap-ups for Workers Compensation and General Responsibility insurance coverage costs. Produces monthly Work Expense to Date reports and functioning with PMs to resolve with Job Supervisors' spending plans for each project.

The Definitive Guide for Pvm Accounting

Proficiency in Sage 300 Construction and Property (previously Sage Timberline Office) and Procore building monitoring software a plus. https://myanimelist.net/profile/pvmaccount1ng. Have to also be skillful in other computer software program systems for the preparation of reports, spread sheets and go various other accounting analysis that might be called for by management. construction accounting. Should have solid business skills and ability to prioritize

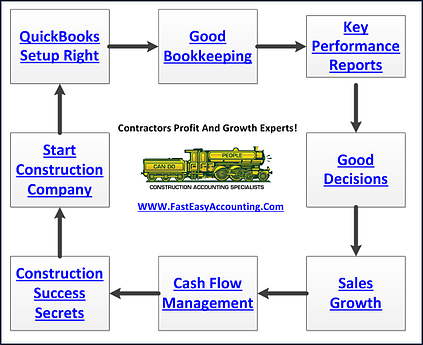

They are the economic custodians that ensure that construction jobs continue to be on spending plan, adhere to tax policies, and preserve economic openness. Building and construction accounting professionals are not just number crunchers; they are tactical partners in the building procedure. Their key role is to manage the financial elements of building jobs, making sure that resources are designated effectively and monetary dangers are lessened.

See This Report on Pvm Accounting

By maintaining a limited grip on job finances, accounting professionals help protect against overspending and financial troubles. Budgeting is a foundation of successful building jobs, and construction accounting professionals are instrumental in this respect.

Browsing the complicated internet of tax guidelines in the construction market can be tough. Construction accounting professionals are fluent in these policies and make sure that the project conforms with all tax obligation requirements. This includes handling pay-roll taxes, sales taxes, and any type of various other tax obligations certain to construction. To excel in the duty of a building and construction accountant, individuals require a strong educational foundation in accountancy and money.

Additionally, accreditations such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Market Financial Expert (CCIFP) are extremely related to in the market. Functioning as an accountant in the building market includes a distinct set of obstacles. Building and construction tasks usually entail limited due dates, altering policies, and unexpected expenses. Accounting professionals have to adjust swiftly to these difficulties to keep the task's monetary health and wellness intact.

Our Pvm Accounting Ideas

Ans: Building accounting professionals develop and monitor spending plans, determining cost-saving possibilities and making sure that the project remains within budget. Ans: Yes, building accountants handle tax compliance for construction jobs.

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms have to make tough choices among several monetary choices, like bidding on one job over an additional, picking funding for products or devices, or setting a job's earnings margin. On top of that, building and construction is a notoriously unpredictable sector with a high failure rate, slow-moving time to payment, and inconsistent capital.

Production includes duplicated processes with conveniently identifiable prices. Production needs various processes, materials, and devices with differing costs. Each job takes area in a new place with differing site conditions and special challenges.

Not known Factual Statements About Pvm Accounting

Frequent usage of various specialty professionals and providers affects efficiency and cash money circulation. Repayment shows up in full or with normal settlements for the full contract quantity. Some part of payment may be held back up until project conclusion also when the professional's work is ended up.

Routine production and temporary agreements result in manageable cash money flow cycles. Irregular. Retainage, slow-moving repayments, and high upfront prices cause long, irregular cash money circulation cycles - construction accounting. While typical makers have the advantage of regulated atmospheres and maximized production processes, building and construction firms need to regularly adapt to every new task. Even rather repeatable projects need modifications as a result of site problems and various other aspects.

Report this page